05 Sep Developers Beware – Implied Warranties under the Home Building Act

Under section 18B of the Home Building Act 1989 (NSW) (Act) warranties (as to fitness for purpose and the like) are implied into residential building contracts. These warranties can be relied upon to make a claim against a builder and the developer who retained the builder if there is defective building work.

Under 18C of the Act, those warranties are extended to the person who bought from the original owner for whom work was done and under 18D the warranties are further extended to subsequent purchasers (technically referred to as successors in title).

Significantly for developers, following 2011 amendments to the Act, 18C (2) now provides that any warranty deemed to have been given by a builder to such a successor in title is also deemed to be given by the developer on whose behalf the residential building work was done.

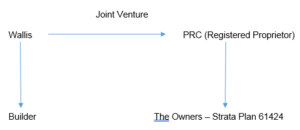

In Ace Woollahra Pty Ltd v The Owner – Strata Plan No 61424 & Anor [2010] NSWCA 101 (Ace Woollahra), the residential development subject of the proceedings involved a joint venture between the owner of the land (PRC) and Wallis Street Developments (Wallis). Wallis was the relevant party who had entered into a design and construction contract with the builder (as represented below).

The residential development was subsequently found to have defects. The Owners Corporation sought to enforce the statutory warranties against the builder on the basis that it was a successor in title to a developer who itself was entitled to the warranties.

The Owners Corporation were successful at first instance. However, the Court of Appeal found that the residential building work carried out by the builder (pursuant to a contract with Wallis) was not work carried out by PRC because PRC did not have a contract with the builder.

Home Building Amendment Act 2011 (NSW)

As a result of the reasoning of the Court of Appeal, the Home Building Amendment Act 2011 (NSW) (Amendment Act) was passed and extended the benefit of the statutory warranties to permit an Owners Corporation (such as that in Ace Woollahra) to enforce those warranties against a builder.

The Amended Act also amended the definition of “Developer” to capture the owner of the land, on whose behalf residential construction work was done, even if they were not party to the building contract (as in Ace Woollahra).

Implied Warranties under Section 18C

Both the “Developer” and the builder will now be liable to the purchasers of property (and their successors in title) for defects. This also means that if a builder becomes insolvent the Developer will have an exposure both to subsequent owners and the Insurer under the Home Building Insurance scheme under the Act.

In the recent case of The Owners – Strata Plan No 66375 v King [2018] NSWCA 170 is an example of a developer’s liability under section 18C of the Act. In that case, the builder was in liquidation and the Owners Corporation proceeded against Mr David King and Ms Gwendoline King (collectively Kings) as “developers”. The Court of Appeal found that the Kings were “developers” under the Act and liable to the Owners Corporation for damages in the sum of $5,093,168.08 in respect of building works which breached the statutory warranties.

Position in respect of Insurance

It is also important to note that a “developer” is a specifically excluded party under insurance policies issued under the Home Building Compensation Scheme. This was considered in The Owners – Strata Plan No 68372 v Allianz Australia Insurance Limited [2014] NSWSC 1807, where the Court held that:-

“The legislative purpose in requiring the insurance to be in place was not to provide cover to a developer such as the Developer. Indeed, the legislation specifically permitted an insurer to exclude liability to a developer, as the Insurer actually did. The legislative purpose was instead to ensure that the insurance was in place for the eventual purchasers of dwellings in the building.”

This means that a developer is not entitled to make a claim on a Home Building Compensation Scheme insurance in the event that the subsequent owners make a claim against the developer for a breach of the statutory warranties under the Act.

For further information or queries relating to this article or if you have any questions in relation to building and construction law matters, please contact Grant Hansen or Alvin Ng on +61 2 9261 8533.

This article is intended to provide general information on the identified legal topics and does not constitute legal advice and should not be relied upon as such.

Sorry, the comment form is closed at this time.